Inventory 101

Inventory

Inventory is one of the most widely misunderstood small business tax preparation topics.

What is inventory?

Inventory is everything you have on hand to sell or use to create products to sell. This is your business's money 'sitting on the shelf' - you've already purchased it or spent money on it, but you haven't received any income back from it. It includes:

-

Products on your shelves or in storage

-

Products being stored for you, such as in Amazon warehouses

-

Raw materials you use to make products

-

Works in progress

-

Finished goods you haven't sold yet

Why Inventory Matters

Inventory is important because it directly affects how much of a deduction you can take for your sold items. You can only deduct the value of the goods that were sold, not just what was purchased for the year. Deducting the entire value of what was purchased for the year may overstate your deductions and show less profit than there actually was, so it's important to calculate the COGS deduction correctly.

What is Cost of Goods Sold (COGS)?

COGS is the total cost of the products you actually sold during the year. This is what essentially 'went out the door' to your customers. It includes the costs of what you paid for the items or materials used to make the items, including any shipping charges or sales taxes paid by you.

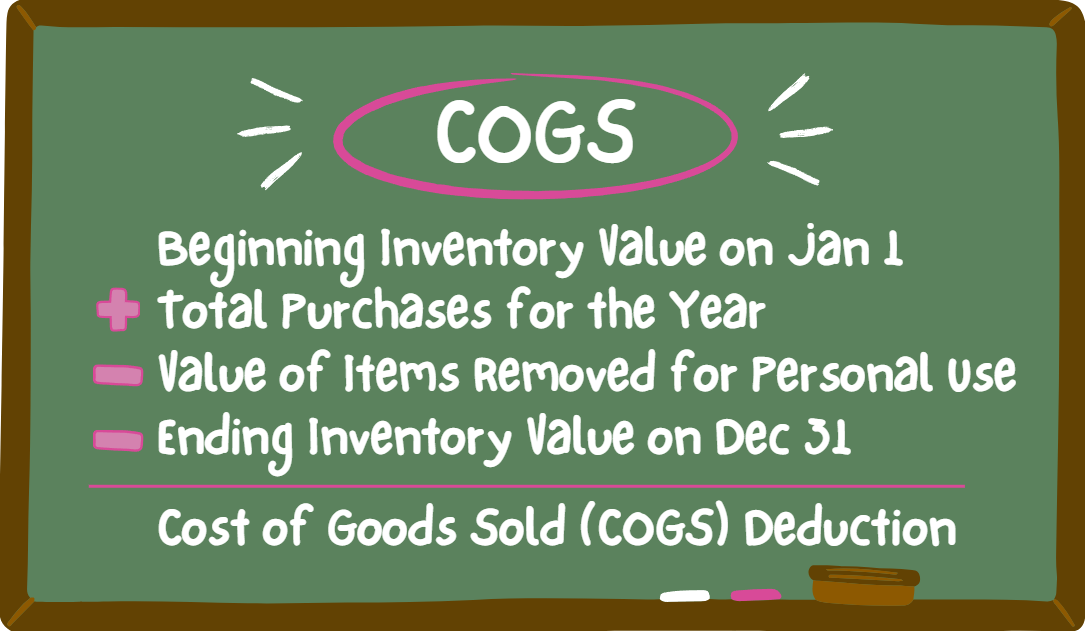

COGS is calculated by a mathmatical formula that takes your beginning inventory value, adds in the year's purchases, takes out any items for personal use, and removes your remaining inventory value. The result should a close approximation of the value of items actually sold for the year.

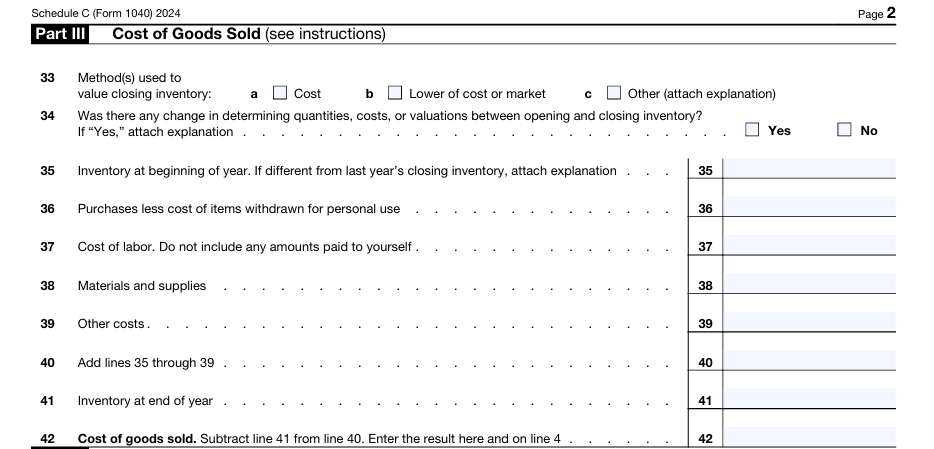

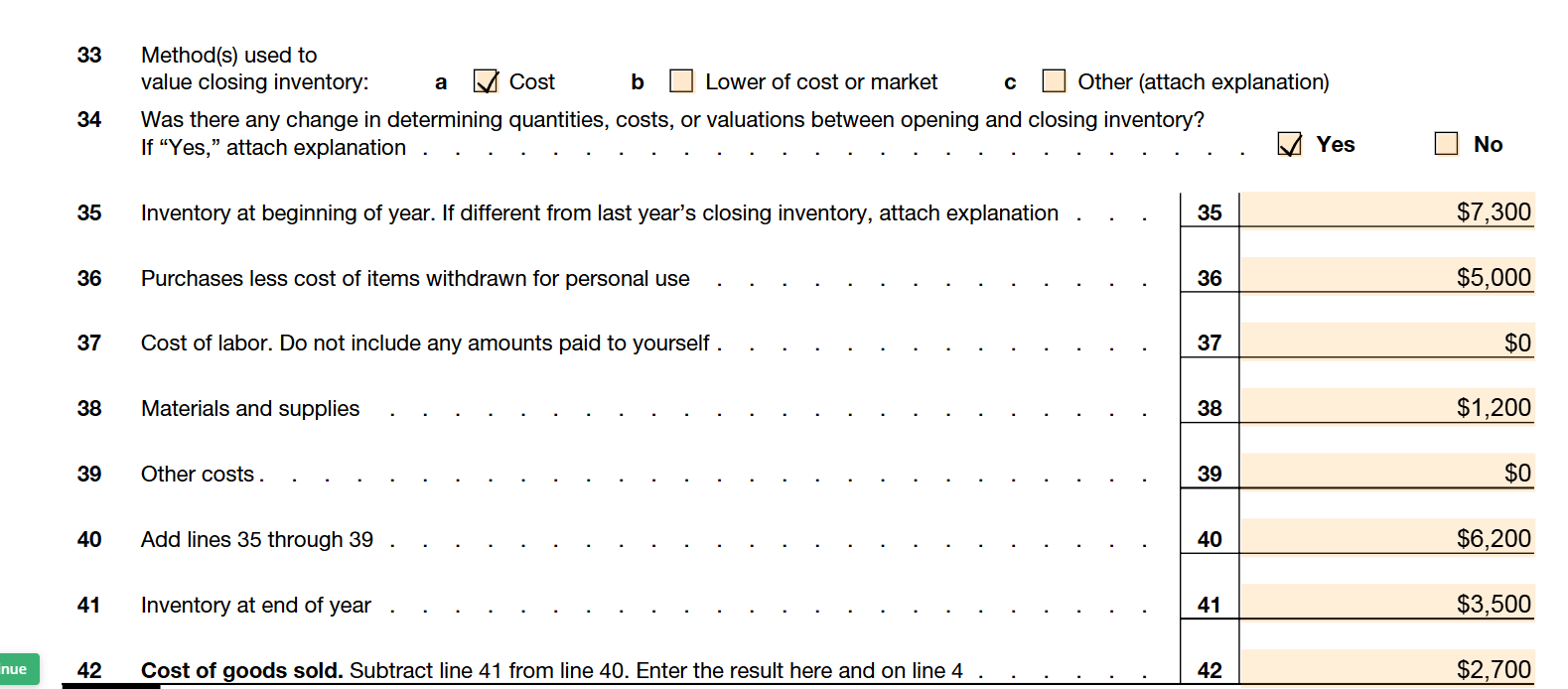

This calculation is actually mapped out on the schedule C of the tax form under part III:

Note:

Lines 36 and 38 are considered interchangeable - 36 is usually used for items purchased direct for resale like pre-made clothing, accessories, etc. Line 38 is usually used for materials that are then created into goods for sale, like fabric, wax for candlemaking, etc. However, they both function the same in the mathmatical formula.

Lines 37 and and 39 are usually only used in major manufacturing businesses to include factory and salary costs. You do not usually see them filled in on a Shopify/Etsy style small business.

Example 1:

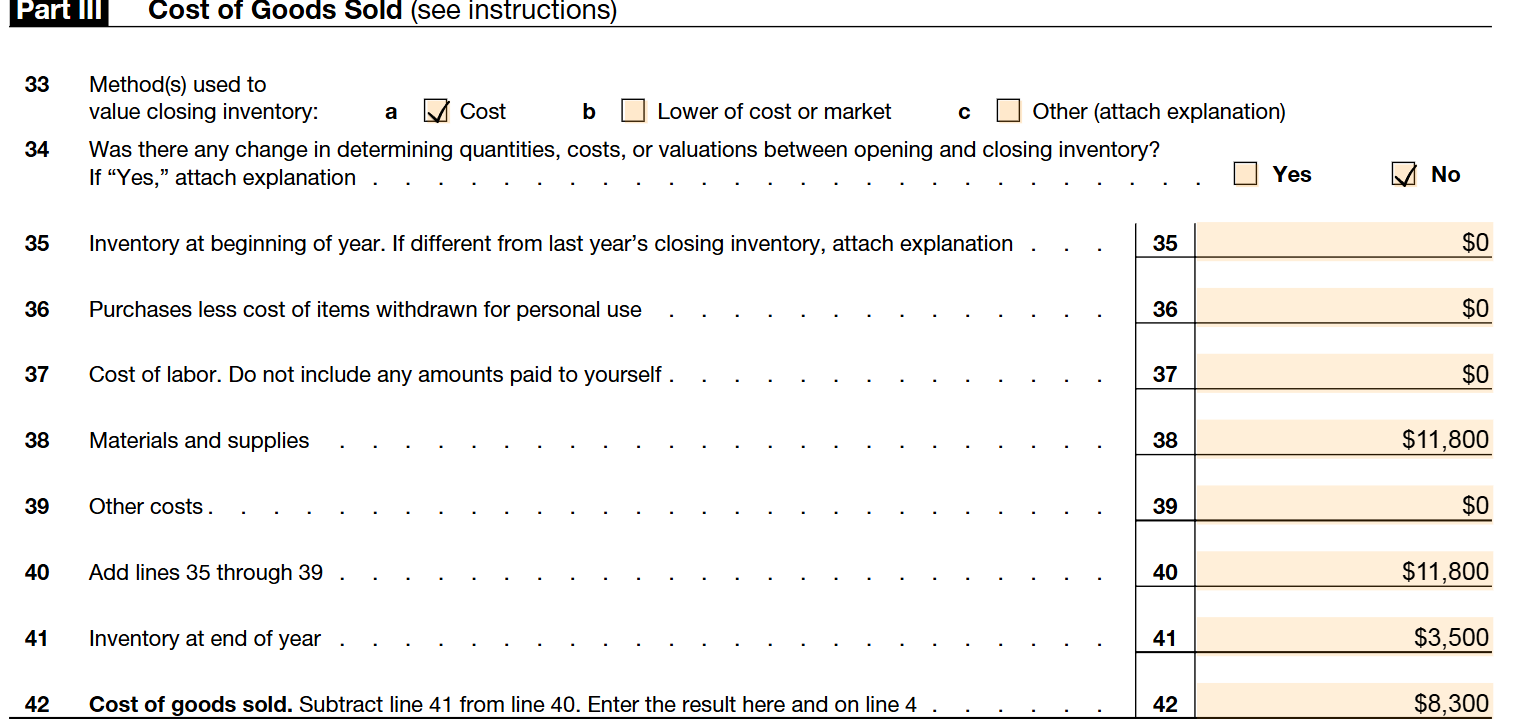

Becky has a small clothing business. She makes items to order, but always has some fabric stock on hand for customers to choose from.

-

Her first year in business, Becky's beginning inventory value is $0 on Jan 1 - she hasn't bought anything yet since she just started!

-

When she purchases fabric, she records the price, the print, and how much she bought. She uses those records to keep track of her purchases for the year.

-

Through her first year in business, she purchases $12,000 in fabric. She takes $200 of that fabric for personal use to sew her daughter a prom dress.

-

This means her purchases for the year are $11,800 - ($12,000 minus the $200 she used for personal use)

-

At the end of the year, on Dec 31, she measures her remaining inventory and compares it to her records. She determines that she has $3,500 worth of fabric still left 'in stock' and no unfinished goods/works in progress.

-

Her COGS, or "Cost of Goods Sold", is $8,300. This is telling the IRS that $8,300 worth of items out of the $12,000 she purchased for the year have been sold.

Example 2:

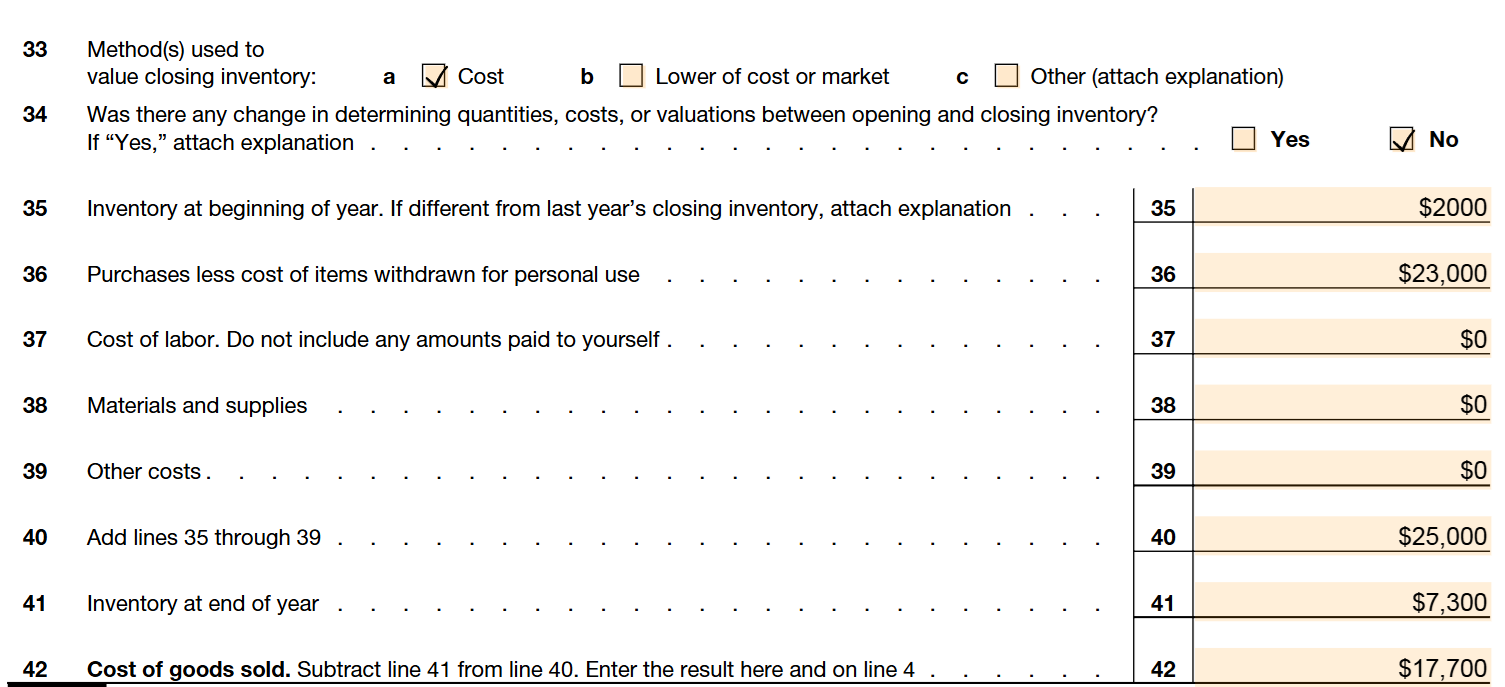

It is Salina's third year in business. She imports t-shirts from abroad and re-sells them on her website. She does not have any made to order products or 'works in progress', because every item is premade.

-

Salina's beginning inventory value is $2000 on Jan 1 - this matches her ending inventory on Dec 31 of the previous year. If it does not match, Salina will need to submit an explaination to the IRS of why it is different (see question 34 on the tax return screenshots).

-

She records each purchase she makes from her vendors, including the shirt print, size, and price per shirt. At the end of the year, her purchases equal $23,000 worth of t-shirts.

-

She stocks them all for sale and does not take any items for personal use. Therefor, her purchases for the year are the full $23,000.

-

She has no cost of labor or materials and supplies since she re-sells finished items. She has no other costs related to inventory.

-

At the end of the year, on Dec 31, she counts how many unsold t-shirts she has left and compares it to her records. She determines she has $7,300 worth of t-shirts left.

-

Her COGS, or "Cost of Goods Sold", is $17,700. This is telling the IRS that approximately $17,700 worth of t-shirts were sold.

Example 3:

It's Larry's second year in business. He purchases both pre-made ballcap hats and raw leather that he engraves with a laser.

-

His first year in business, Larry made a mistake on his inventory counting. He adjusted his methods and now has a correct count/value of $7,300, but it is different than last year's Dec 31 ending inventory, which was listed at $8,000.

-

Therefor, on his schedule C, Larry checks the box that says there was a change in his determination and attaches a brief explaination of what was miscounted and why the change happened. This tells the IRS that we are aware the past year's ending value and current year's beginning value does not match - otherwise, their systems may flag it as an inaccurate math calculation.

-

Then he puts in his correct Jan 1 inventory number of $7,300 as his beginning year value.

-

He records each purchase of hats and leather, including the prints or designs, sizes, colors, and costs. His total purchases for the year are $5,000 in ballcap hats and $1,200 in leather to turn into patches. None of these items are kept for personal use. He has no cost of labor or other costs.

-

At the end of the year, he counts his ballcaps and measures his leather and compares them to his purchase records. He finds he has $3,000 in ballcaps and $500 worth of leather left.

-

His ending inventory is therefor $3,500.

-

His cost of goods sold is $2,700, meaning that throughout the year he sold $2,700 worth of products to customers.

Common mistakes with Inventory:

1. Deducting the full amount of what was purchased during the year instead of what was sold. This is a very, very common mistake and can often be easily corrected, but should be done under a professional's guidance.

2. Listing inventory value at retail value. This is incorrect! All inventory values should be at the price your business paid for the items, not what they sell for to customers.

3. Not keeping track of inventory or purchases at all. If you're skipping your COGS deduction, you are paying more tax than you should be, because that total is deducted from your business's taxable profit. A lower taxable profit = lower taxes, so we want to take any legitimate deductions we can.

Oh no! I've been doing inventory wrong!

Rule 1: Don't panic. There are no emergencies in tax prep and everything can be corrected.

There's a good chance if you have a small business, with under a few thousand dollars worth of inventory, that adjusting the numbers to do it 'correct' may not make a noticiable difference in your previous tax return numbers. Regardless, it is a good idea to correct your methods going forward to accurately reflect your business's income and expenses.

If you've been doing your inventory incorrectly, reach out for a consultation and we can go through it and get you on the right path!